SB 1 Signature and Item Disapproval Proclamation (85R)

TO ALL TO WHOM THESE PRESENTS SHALL COME:

Senate Bill No. 1, the General Appropriations Act, having been duly certified by the Comptroller of Public Accounts pursuant to Article III, Section 49a of the Texas Constitution, has been presented to me for action.

I am once again signing a budget that addresses the most pressing challenges faced by our state. This budget funds a life-saving overhaul of Child Protective Services, ensuring children in Texas’ foster care receive the protection they deserve.

Even in a tight budget climate, this budget prioritizes the safety and well-being of all Texans. It continues to fund our state’s role in securing the border, adding an additional 250 troopers to keep our communities safe. It funds the state’s natural disaster response costs to provide state resources when disaster strikes. And it better protects our law enforcement officers across the state by funding grants for bulletproof vests.

This budget ensures the workforce of today and tomorrow have the resources they need to keep Texas’ economy growing and thriving. Under Senate Bill No. 1, all eligible prekindergarten students will receive a high-quality education by increasing standards statewide. And the state will remain competitive on the job creation front with funds to help Texas remain the best state in the nation for doing business.

This budget achieves all of these goals while restraining state-controlled spending below the growth in the state’s estimated population and inflation. During the upcoming special session of the 85th Legislature, passage of legislation or a constitutional amendment to ensure the state continues to budget within responsible spending limitations will remain a top priority.

In order to further restrain the growth of government and reduce the expenditure of taxpayer funds, this veto proclamation includes approximately $120 million in reductions. I hereby object to and veto the following items from Senate Bill No. 1 and include a statement of my objections to each of those items.

Article I - General Government

Secretary of State

C. 1.2. Strategy: Colonias Initiatives 2018: $ 429,856 2019: $ 429,235

Services to help improve the lives of Texans living in colonias are funded across numerous other state agencies, including the Office of the Attorney General, the Department of State Health Services, the Health and Human Services Commission, the Department of Housing and Community Affairs, and the Department of Transportation. Each of these agencies provides direct client services to Texans living in colonias, while the Secretary of State primarily serves in a liaison and reporting role. I therefore object to and disapprove of this appropriation.

Article III – Education

Texas Education Agency

70. Collaborative Dual Credit Program Evaluation. Out of funds appropriated above in Strategy B.3.2, Agency Operations, $72,131 in each fiscal year of the biennium in General Revenue shall be used to dedicate one Full-Time Equivalent (FTE) to collaboratively, along with the Texas Higher Education Coordinating Board:

identify existing capabilities, limitations, and costs to comprehensively evaluate dual credit opportunities, including an assessment of the adequacy of information on dual credit costs and local funding structures and the ability to identify ineffective and inefficient dual credit programs;develop a plan to create a cross-agency, statewide dual credit student outcome reporting and evaluation tool to measure acceleration, tuition saved, and efficient and effective practices for offering dual credit. The agencies shall consider the role both Preschool-to- Grade-16 (P-16) Councils and Education Research Centers could have in this evaluation strategy;report their joint findings regarding the comprehensive evaluation of dual credit to the Governor, Legislative Budget Board, and Legislative committees responsible for oversight of public and higher education no later than August 31, 2018; andissue guidance, using existing data on all dual credit programs, regarding the best and most effective practices for school districts and dual credit partners to continue or initiate dual credit offerings.

Neither participating state agency requested funding for this item in their 2018–19 Legislative Appropriations Request. This new rider is duplicative of an existing dual credit study currently being commissioned by the Texas Higher Education Coordinating Board. To keep Texas fiscally strong, we must limit unnecessary state spending. I therefore object to and disapprove of this appropriation.

Higher Education Coordinating Board

55. Collaborative Dual Credit Program Evaluation. Out of funds appropriated above in Strategy B.1.1, Central Administration, $72,131 in each fiscal year of the biennium in General Revenue shall be used to dedicate one Full-Time Employee (FTE) to collaboratively, along with the Texas Education Agency:

identify existing capabilities, limitations, and costs to comprehensively evaluate dual credit opportunities, including an assessment of the adequacy of information on dual credit costs and local funding structures and the ability to identify ineffective and inefficient dual credit programs;develop a plan to create a cross-agency, statewide dual credit student outcome reporting and evaluation tool to measure acceleration, tuition saved, and efficient and effective practices for offering dual credit. The agencies shall consider the role both Preschool-to- Grade-16 (P-16) Councils and Education Research Centers could have in this evaluation strategy;report their joint findings regarding the comprehensive evaluation of dual credit to the Governor, Legislative Budget Board, and Legislative committees responsible for oversight of public and higher education no later than August 31, 2018; andissue guidance, using existing data on all dual credit programs, regarding the best and most effective practices for school districts and dual credit partners to continue or initiate dual credit offerings.

Neither participating state agency requested funding for this item in their 2018–19 Legislative Appropriations Request. This new rider is duplicative of an existing dual credit study currently being commissioned by the Texas Higher Education Coordinating Board. To keep Texas fiscally strong, we must limit unnecessary state spending. I therefore object to and disapprove of this appropriation.

UT Austin

5. Legislative Law Clinic. Out of the funds appropriated above, up to $75,000 in each year of the biennium shall be used for the continuation of the Legislative Lawyering Clinic in the School of Law. These funds shall be used to pay for clinic academic and administrative personnel, research, surveys, and other expenses associated with the clinic

The University of Texas at Austin did not request funding for this item in its 2018–19 Legislative Appropriation Request. If the Legislative Law Clinic is a priority, the University may continue to use other resources to maintain this program. I therefore object to and disapprove of this appropriation.

Article IV – The Judiciary

Office of Court Administration, Texas Judicial Council

15. Guardianship Compliance Project. Amounts appropriated above from the General Revenue Fund include $2,407,967 in each fiscal year in Strategy A.1.1, Court Administration, and $140,650 in fiscal year 2018 and $60,150 in fiscal year 2019 in Strategy A.1.2, Information Technology, as well as 31.0 FTEs each fiscal year, for the Guardianship Compliance Project.

This rider creates a new state level compliance structure for guardians. This would result in a permanent increase both in government spending and employment. While I signed multiple bills to reform the guardianship process, a new state compliance and reporting structure for guardians is unnecessary bureaucracy and unnecessary spending. That is why I will veto Senate Bill 667. I therefore object to and disapprove of this appropriation

Article V – Public Safety and Criminal Justice

Department of Public Safety

F. 1.2. Strategy: Safety Education 2018: $4,741,451 2019: $4,741,451

This appropriation exceeds the amount requested by the Department of Public Safety to fund this new strategy. If it is determined by the Department of Public Safety that improving the safety on our roads is contingent on an increased appropriation of tax funds for this campaign effort, then the Department of Public Safety can identify those needs and present them to the legislature at that time. Until that time, I object to and disapprove of one year of this appropriation.

56. Public Safety Grant for the Greater Houston Area. Out of General Revenue Funds appropriated above in Strategy C.2.1, Public Safety Communications, the Department of Public Safety shall grant $4,000,000 in fiscal year 2018 to a non-profit entity in Houston that is dedicated to preventing and solving crime in the Greater Houston Area through programs emphasizing crime information reporting, student and parent education, and community empowerment.

The Department of Public Safety’s core mission is to serve and protect citizens of Texas as the state’s primary law enforcement agency. Over recent years, efforts have been made to help the agency concentrate on its core mission and to transfer grant-making activities to other state agencies. This appropriation, for which the Department did not request funding in its 2018-19 Legislative Appropriation Request, would return the Department to being a grant-making entity. This veto will not prevent Houston Crime Stoppers from being able to receive grant funding from the Office of the Governor’s Criminal Justice Division—or encumber Houston Crime Stoppers’ ability to provide awards to appropriate recipients. I therefore object to and disapprove of this appropriation.

Article VI – Natural Resources

Texas Commission on Environmental Quality

7. Air Quality Planning. Amounts appropriated above include $6,000,500 for the biennium out of the Clean Air Account No. 151 in Strategy A.1.1, Air Quality Assessment and Planning, for air quality planning activities to reduce ozone in areas not designated as nonattainment areas during the 2016-17 biennium and as approved by the Texas Commission on Environmental Quality (TCEQ). These areas may include Waco, El Paso, Beaumont, Austin, Corpus Christi, Granbury, Killeen-Temple, Longview-Tyler-Marshall, San Antonio, and Victoria. These activities may be carried out through interlocal agreements and may include: identifying, inventorying, and monitoring of pollution levels; modeling pollution levels; and the identification, quantification, implementation of appropriate locally enforceable pollution reduction controls; and the submission of work plans to be submitted to the TCEQ. The TCEQ shall allocate $350,000 to each area and the remaining funds to each area based on population in excess of 350,000. The grant recipients shall channel the funds to those projects most useful for the State Implementation Plan (SIP).

This program funds, among other items, bicycle use programs, carpooling awareness, environmental awareness campaigns, and locally enforceable pollution reduction programs in near non-attainment areas, which can be funded at the local government level. Resources in the Clean Air Account should be prioritized to directly address problems in our non-attainment areas of the state so that we are better positioned to combat the business-stifling regulations imposed on these areas by the Environmental Protection Agency. I therefore object to and disapprove of this appropriation.

24. Low-Income Vehicle Repair Assistance, Retrofit, and Accelerated Vehicle Retirement Program (LIRAP). Amounts appropriated above out of the Clean Air Account No. 151 in Strategy A.1.1, Air Quality Assessment and Planning, include $43,468,055 in each fiscal year of the 2018-19 biennium in estimated fee revenues from vehicle inspection and maintenance fees generated pursuant to Health and Safety Code, §§382.202 and 382.302, to fund the Low-income Vehicle Repair Assistance, Retrofit, and Accelerated Vehicle Retirement Program (LIRAP). Out of these amounts, not more than $253,893 in each fiscal year shall be used by the Texas Commission on Environmental Quality (TCEQ) for costs associated with administering the LIRAP as authorized in Health and Safety Code, §382.202, and all remaining funds shall be used as LIRAP grants to local governments.

Amounts appropriated above in Strategy A.1.1, Air Quality Assessment and Planning, also include $4,829,673 in each fiscal year of the 2018-19 biennium out of the Clean Air Account No. 151 to be used only for purposes authorized in Chapter 382 of the Health and Safety Code for county-implemented local initiatives projects to reduce air emissions.

Amounts appropriated above for LIRAP grants and local initiative projects also include an estimated $1,196,172 each fiscal year in estimated fee revenue generated from Travis County and $483,736 each fiscal year in estimated LIRAP fee revenue generated from Williamson County. The TCEQ shall allocate, at a minimum, the estimated revenue amounts collected in each of the counties during the 2018-19 biennium to provide LIRAP grants and local initiatives projects in those counties.

In addition to the amounts appropriated above, any additional revenues from vehicle inspection and maintenance fees generated from additional counties participating in the LIRAP beginning on or after September 1, 2017 are appropriated to the TCEQ for the biennium. Such funds shall be used to provide grants to local governments and to cover administrative costs of the TCEQ in administering the LIRAP.

The Low-Income Vehicle Repair Assistance Program (LIRAP) has done little to provide measureable improvements to air quality in our state’s non-attainment areas. Additionally, previously approved appropriations for this program have yet to be fully spent by the local entities who administer this program. The LIRAP program is similar to the ill-conceived and dubious Cash for Clunkers program and should be abolished. A veto of this appropriation will not only allow local entities to spend previously approved allocations, but will also allow counties an opportunity to reassess if they should continue to charge an optional local fee for this program. I therefore object to and disapprove of this appropriation.

Soil and Water Conservation Board

7. Water Supply Enhancement. Included in amounts appropriated above in Strategy C.1.1, Water Conservation and Enhancement, is $2,495,575 in fiscal year 2018 and $2,495,575 in fiscal year 2019 out of the General Revenue Fund for the water supply enhancement program. These funds shall be used for supporting existing and implementing new water supply enhancement projects designated by the Soil and Water Conservation Board. Any unobligated and unexpended balances from this appropriation as of August 31, 2018 are appropriated for the same purpose for the fiscal year beginning September 1, 2018.

This program primarily funds efforts to remove brush from private land. Texas landowners have a rich history of improving the value of their land through various self-funded measures. As a general concept, government should abstain as much as possible from inserting itself into private property matters unless a greater public need commands otherwise. For transition purposes, the first year of the program will be funded in the amount of $2.495 million. Any amount of funding for this program can be carried forward as unexpended balances to the second year. Except for any potential unexpended balance, I therefore object to and disapprove of the second year of this appropriation.

Water Development Board

26. Appropriation: Study of Aquifers and Brackish Groundwater. Amounts appropriated above in Strategy A.2.2, Water Resources Planning, include $1,849,233 in fiscal year 2018 and $150,767 in fiscal year 2019 out of the General Revenue Fund for contract costs for studies related to designating priority zones for the production of brackish groundwater in aquifers throughout the state as identified. The amounts of $167,787 in fiscal year 2018 and $150,767 in fiscal year 2019 shall be used for administrative costs in implementing the studies. The Board shall report to the Legislature on its progress relating to the studies not later than December 1 of each year.

The Texas Water Development Board has already completed several studies on brackish groundwater in various regions of the state. I therefore object to and disapprove of this appropriation.

Article VII – Business and Economic Development

Texas Lottery Commission

A. 1.11. Strategy: Retailer Bonus 2018: $4,200,000 2019: $4,200,000

Lottery retailers already receive a commission based on the volume of tickets sold at that location. This bonus, which is in addition to the commission, is intended to be an incentive for retailers to sell lottery tickets. The bonus was created in 1993 to help jumpstart the rollout of the lottery, but the lottery is now well established in the state. I therefore object to and disapprove of one year of this appropriation.

Article X – The Legislature

House of Representatives

5. Unexpended Balances: Legislative Budget Board.

a. Any unobligated and unexpended balances remaining as of August 31, 2017, from appropriations made to the Legislative Budget Board are appropriated to the Legislative Budget Board for the biennium beginning September 1, 2017.

b. Any unobligated and unexpended balances remaining as of August 31, 2018, from appropriations made to the Legislative Budget Board are appropriated for the same purposes for the fiscal year beginning September 1, 2018.

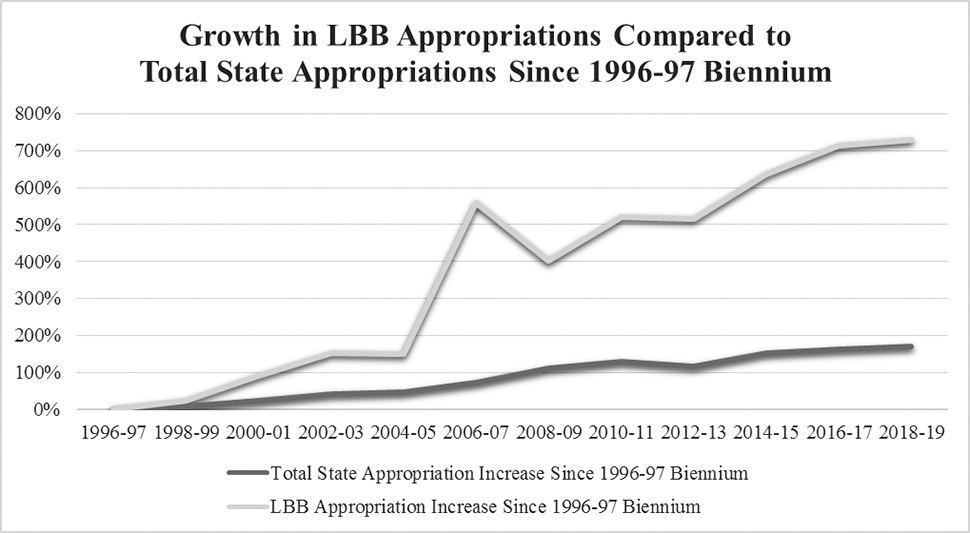

Since the 1996–1997 biennium, direct appropriations to the Legislative Budget Board (LBB) have skyrocketed by more than 700 percent compared to just 171 percent for the entire state. This growth has corresponded with greater government authority being delegated to unelected bureaucrats rather than being undertaken by elected officials directly accountable to the voters. To begin the process of restoring the LBB to its intended limited purpose, I therefore object to and disapprove of this appropriation.

I have signed Senate Bill No. 1 together with this proclamation stating my objections in accordance with Article IV, Section 14 of the Texas Constitution.

Since this Legislature by its adjournment of the Regular Session has prevented the return of this bill, I am filing this bill and these objections in the office of the Secretary of State and giving notice thereof by this public proclamation according to the aforementioned constitutional provision.

IN TESTIMONY WHEREOF, I have signed my name officially and caused the Seal of the State to be affixed hereto at Austin, this 12th day of June, 2017.

GREG ABBOTT

Governor