Federal Opportunity Zones in Texas

The Opportunity Zone program, established in 2017 and administered by the U.S. Department of Treasury, has been updated and made permanent through U.S. House Resolution 1—the One Big Beautiful Bill Act—passed by Congress in 2025. The renewed Opportunity Zone 2.0 program will take effect January 1, 2027, following the sunset of current designations at the end of 2026. The program offers incentives, in the form of capital gains tax abatement, for those who invest eligible capital into Qualified Opportunity Zone assets.

Opportunity Zone 2.0 Program

Under Opportunity Zone 2.0, state governors will be able to nominate 25% of their respective state’s eligible census tracts every ten years for U.S. Treasury certification as Opportunity Zone tracts.

- Nominations will begin July 1, 2026.

- Eligible tracts are expected to be released by the U.S. Treasury Spring 2026.

- Decennial redesignations: Opportunity Zone 2.0 designations are effective for 10 years beginning January 1, 2027.

Note: Tract designations under the initial Opportunity Zone program (OZ 1.0) remain eligible through December 31, 2028, creating a two-year overlap. OZ 1.0 designated tracts will not be automatically recertified under Opportunity Zone 2.0. However, they may be submitted for reconsideration under the new program. See Designation Process and Nomination Packet sections below for additional guidance.

Opportunity Zone 2.0 continues the program’s mission of encouraging long-term private investment in low-income communities by offering federal tax incentives to investors, while strengthening accountability and refining eligibility criteria. The updated framework emphasizes support for rural communities, tightens the income threshold for eligible tracts and removes the contiguous tract allowance. Additional benefits, including enhanced capital gains exclusions and modified investment requirements, are designed to increase the flow of private capital into underserved areas.

Program Highlights

- To be eligible, a tract must have a median family income (MFI) less than 70% of state/metro MFI; or poverty rate greater than or equal to 20% and MFI less than or equal to 125% of state/metro MFI.

- The Contiguous Tract Rule, which allowed designation of tracts next or adjacent to qualifying tract, has been eliminated.

- There is a standard five‑year deferral plus 10% basis step‑up for all investors.

- A 10‑year tax‑free appreciation remains; stepped-up Fair Market Value after 30 years (no “forced exit”).

- Rural enhancements: Qualified Renewal Opportunity Fund that maintains greater than or equal to 90% of capital in rural Opportunity Zones qualify for 30% step‑up after five years; substantial improvement threshold in rural Opportunity Zones has been reduced to 50% (vs. 100%).

Note: Rural area means 1) any area other than a city or town with a population greater than 50,000, and 2) any urbanized area contiguous and adjacent to a city or town with a population greater than 50,000.

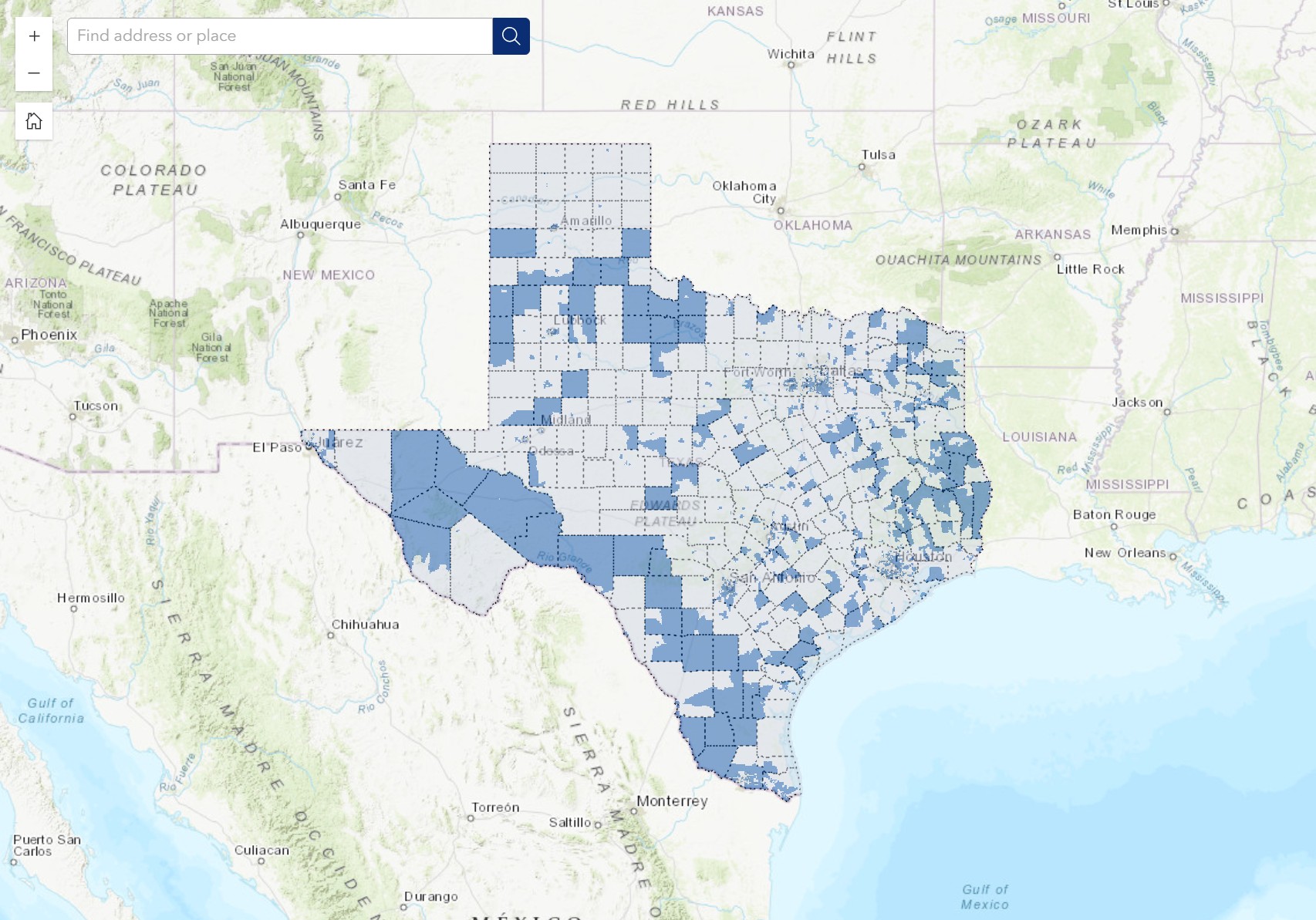

To assist communities in preparing for the nomination process, the Office of the Governor has created a mapping tool to highlight census tracts which may qualify based on current estimates from the American Community Survey (2019 – 2023). Please note this map is for informational purposes only, as the official list of eligible tracts has not yet been released by the U.S. Treasury.

|

Map: Potential eligible tracts that may qualify for Texas Opportunity Zones 2.0 |

Further details and guidance will be provided in the coming months; please check back for updates as they become available. Communities, stakeholders and members of the public are invited to share questions, comments or relevant information with our Opportunity Zone Team at OppZone2.0@gov.texas.gov.

Designation Process

State governors can nominate 25% of their respective state’s eligible census tracts every ten years as Opportunity Zone tracts. The U.S. Department of Treasury will begin the Opportunity Zone 2.0 designation on July 1, 2026.

The Texas Economic Development & Tourism Office (EDT) within the Office of the Governor will lead the efforts to develop a transparent, data-driven selection process for Opportunity Zone 2.0. To do so, EDT will ask economic development organizations (EDOs) and county judges to submit eligible tracts in their communities for consideration based on the following criteria:

- Statutory compliance: Communities should only nominate tracts that clearly meet federal eligibility.

- Local support: Strong consideration will be given for those tracts which the local community will support through incentives offered, rebates and agreements.

- Project viability: Communities should prioritize sites where private capital can realistically deploy in 24–48 months and where investments drive inclusive growth in the community (E.g. affordable housing commitments, anti-displacement tools, workforce initiatives, etc.).

- Geographic balance: EDT will ensure representation across regions of Texas; leverage rural incentives without selecting unworkable tracts and provide an additional incentive for tracts which have been affected by a declared disaster over the last three (3) years.

From the list of eligible tracts nominated by the local communities, EDT intends to finalize and submit tracts for Opportunity Zone 2.0 designations to the U.S. Department of Treasury no later than August 3, 2026.

Nomination Packet

The Opportunity Zone 2.0 Nomination Packet is available to local economic development organizations (EDOs) and county judges (for those counties with no local or regional economic development organization).

To ensure that both communities and EDT have sufficient time to review, compile and make a final determination, EDT asks that communities submit their nominations no later than June 26, 2026.

- Frequently Asked Questions (FAQs) – coming soon

Opportunity Zone 1.0 Program

In March 2018, Governor Greg Abbott submitted the state’s Opportunity Zone 1.0 designations to the U.S. Treasury to encourage long-term investment in eligible Texas communities. Governor Abbott nominated 628 census tracts in 145 Texas counties as potential Opportunity Zones across the state's total 5,265 census tracts. To determine Opportunity Zones within Texas’ eligible tracts, a multi-step process was used to identify eligible areas in particular need due to chronic unemployment, lower population density and significant economic disruptors, such as natural disasters.

View a comprehensive map of Texas’ current designated Opportunity Zones, or download the full PDF listing of designations.

Additional Resources

U.S. Department of Housing and Urban Development’s Opportunity Zone Website